1.Nation in Motion

The United Arab Emirates (UAE) is undergoing a period of dynamic growth and transformation, solidifying its position as a regional hub for commerce, tourism, and investment. Driven by steady economic development, rising population levels, and a thriving tourism sector, the UAE’s food and beverage market is poised for significant expansion in the coming years.

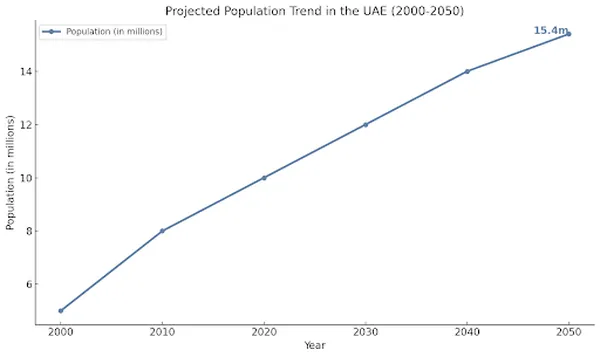

The UAE’s population, currently at 10.64 million in 2023, is projected to grow to 15.37 million by 2050 (Figure 1), reflecting sustained demographic growth fueled by natural increase and international migration. This rapid population expansion will undoubtedly amplify demand for food and beverage products, presenting substantial opportunities for businesses operating within this sector.

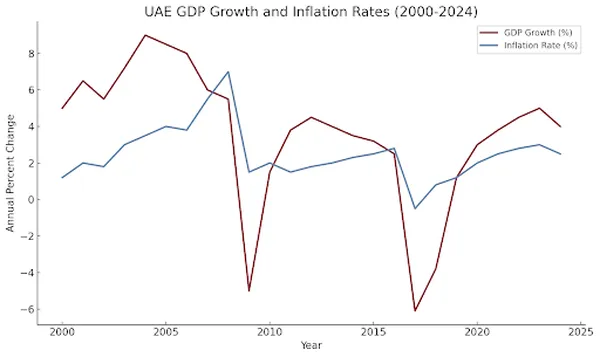

Complementing this trend, the UAE’s economy continues to demonstrate resilience and strength. As shown in Figure 2, the real GDP growth has reached an annual percentage increase of 4%, with per capita GDP rising to $49,500 in 2023. This economic prosperity translates into higher consumer purchasing power and growing demand for premium, high-quality food and beverage options.

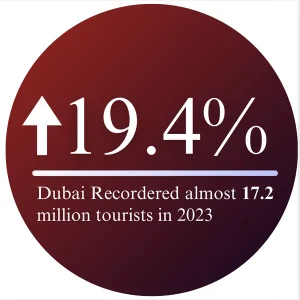

Furthermore, the UAE’s position as a global tourism destination remains a key market driver. According to the Dubai Chamber of Commerce, in 2023, the country welcomed 17.2 million international visitors, marking a remarkable 19.4% increase compared to 2022. This surge in tourism has bolstered the hospitality industry, fueling demand for diverse culinary offerings and creating new avenues for growth in the food and beverage market.

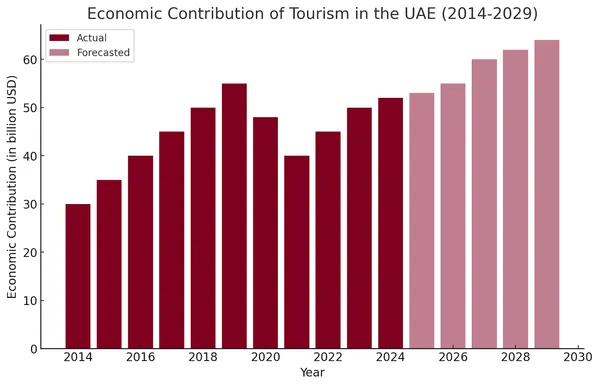

UAE’s tourism sector’s economic contribution from 2014 to 2029, has a steady growth pre-2020, a sharp decline during the pandemic in 2020, and a strong recovery thereafter (Figure 3).

By 2024, the sector stabilizes at pre-pandemic levels, with forecasted growth showing consistent increases, reaching over $60 billion by 2029.

Together, these factors—population growth, economic advancement, and a booming tourism industry—are shaping the UAE’s food and beverage market, paving the way for continued expansion and innovation in the near future.

2.Demography of Population

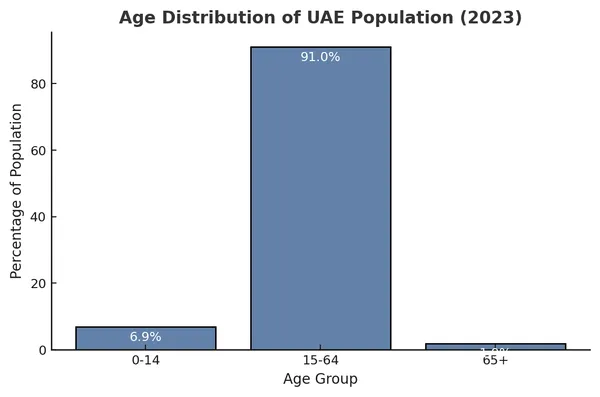

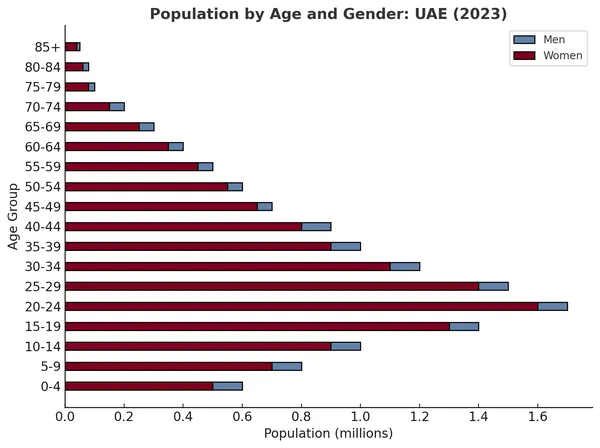

UAE boasts a diverse population of 10 million, comprising 6.8 million males and 3.2 million females. As shown in Figure 4, the working-age group (15-64 years) represents 81.4% of the population, making it the largest and most active consumer base. This segment holds substantial spending power with younger consumers driving demand for digital shopping experiences, as seen in the growing prominence of e-commerce platforms.

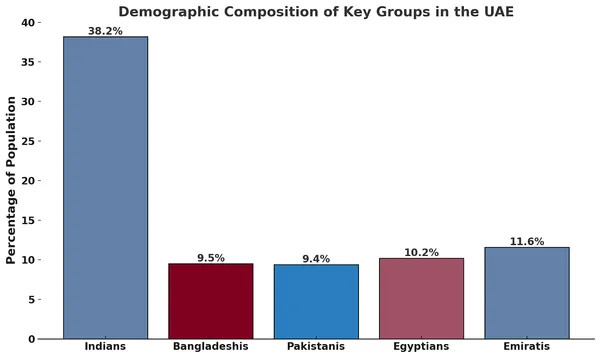

The UAE’s population is marked by a rich ethnic diversity, with 88.4% of residents being immigrants.

As shown in Figure 6, the distribution of different nationalities in the UAE highlights the diverse demographic landscape and the variety of consumer needs and preferences across the market.

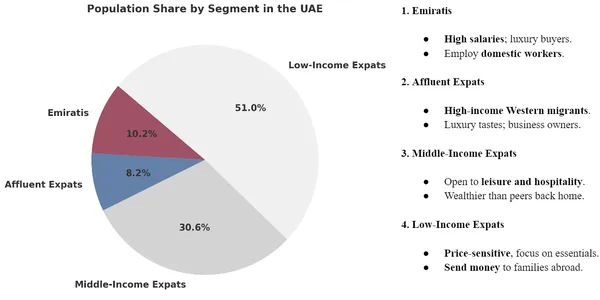

The UAE’s population is both diverse and dynamic, creating a thriving consumer market shaped by cultural influences, economic segmentation, and evolving preferences. With expatriates forming the majority of the population, consumer behavior is segmented across different economic tiers, which greatly influences purchasing patterns and demand. Understanding these tiers is essential for businesses seeking to tailor their products and marketing strategies to meet the unique needs of UAE consumers.

The population can broadly be categorized into four economic segments as presented in Figure 7, each displaying distinct consumption preferences.

The UAE’s dynamic demographic composition and evolving consumer behaviors present significant opportunities for businesses operating within the food and beverage sector. Factors such as cultural diversity and income levels continue to shape demand for a wide range of products, making it essential for producers and exporters to adapt to these changing preferences.

3.Consumption Trends

The UAE’s food and beverage market is at the forefront of a significant transformation, shaped by shifting consumer preferences, the rise of luxury dining, and increasing health challenges within the population. These trends highlight a lucrative and evolving market for premium, innovative offerings. While these changes are reflective of broader global movements, the UAE’s affluent and diverse population, combined with its strategic role as a regional hub, creates unique opportunities for growth. The following sections explore three critical consumption trends reshaping the UAE market in detail.

3.1 Green and Organic Movement

The UAE has been witnessing a remarkable surge in demand for green and organic eating, driven by increasing health consciousness and environmental awareness. Affluent consumers, in particular, are leading this shift, as they are more willing to invest in premium food products that align with wellness and sustainability goals. Organic options have expanded beyond niche markets to become mainstream offerings in supermarkets, specialty stores, and high-end restaurants.

The organic food market in the UAE was valued at USD 42.57 million in 2023 and is projected to grow to USD 55.63 million by 2029, reflecting a CAGR of 4.56% during the forecast period (TechSci Research, 2024). This growth is driven by rising health consciousness among the UAE’s population, particularly younger consumers, and the increasing prevalence of lifestyle-related ailments such as obesity, diabetes, and cardiovascular diseases.

These health challenges have amplified demand for organic food products, particularly fruits and vegetables free from chemical fertilizers and pesticides.

The UAE government is actively implementing initiatives to reduce obesity and other health issues by promoting healthier dietary choices. This includes developing regulations for organic farming and introducing certification processes to ensure locally grown produce meets international standards. The establishment of organic farming departments and associations further supports this sector’s growth.

Despite the positive outlook, challenges remain, including limited domestic production, high costs of organic food, and reliance on imports due to the UAE’s arid climatic conditions and restricted water resources. However, the increasing penetration of modern retail formats and e-commerce platforms is expanding consumer access to organic products. A shift toward organic packaged foods and beverages indicates growing consumer awareness and broader acceptance of organic products.

As awareness of the benefits of organic food continues to grow, and with the government and private sectors making significant efforts, the UAE organic food market presents an attractive segment for both local and international players, poised for robust growth in the coming years.

In this regard, eco-conscious initiatives like the UAE Green Agenda 2030 and the National Climate Change Plan 2017–2050 play a pivotal role in advancing sustainability in the region. These programs aim to foster a competitive knowledge economy, enhance quality of life, and promote green living through clean energy, sustainable resource use, and climate action (UAE Government). By targeting ambitious goals such as reducing emissions and driving economic growth with innovative solutions, these initiatives are creating an ecosystem that supports the growth of organic farming and sustainable food production in the UAE.

3.2 Rise of Luxury Dining

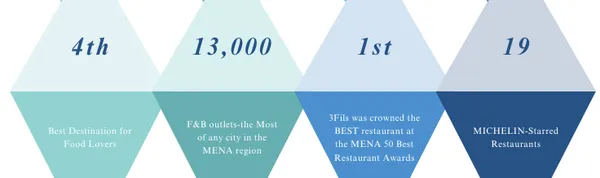

With a growing population and booming tourism, the number of food and beverage outlets in the UAE is expanding at an accelerated pace. As the tourism hub of the country, Dubai has established itself as a global gastronomy hub, accounting for 80% of the UAE’s luxury dining establishments.

According to the Dubai Gastronomy Industry Report (2022), This thriving sector is driven by the city’s cosmopolitan population and its ability to cater to a wide array of culinary preferences. Chefs and restaurateurs in Dubai constantly innovate to differentiate their offerings, creating a robust demand for unique, premium-quality ingredients.

From introducing exotic flavors to reinventing traditional dishes, Dubai’s luxury dining establishments reflect the city’s emphasis on culinary creativity and excellence.

For these travelers, dining is an integral part of the cultural experience, and Dubai delivers with its array of high-end and experiential dining options. This combination of resident affluence and tourism-driven demand makes the city an ideal market for suppliers looking to introduce premium, exclusive, and innovative food products.

Furthermore, as Dubai positions itself as a leader in global gastronomy, opportunities abound for ingredients and products that can help fine dining establishments elevate their offerings. From high-quality fruits to rare herbs and spices, luxury dining establishments are primed to embrace products that bring authenticity, creativity, and exclusivity to their menus.

3.3 Growing Health Challenges

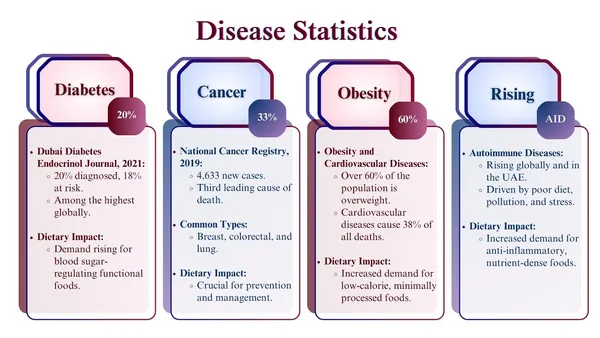

The UAE is facing an alarming rise in chronic diseases, many of which are directly linked to lifestyle and dietary habits. These health concerns are reshaping consumption patterns, with a growing emphasis on natural, functional, and health-oriented food products.

The growing health concerns depicted in the Figure below , displays the rate and concerns that have grown immensely over the past years especially in the UAE. These trends have prompted consumers to view food as a preventative tool, shifting preferences toward natural, functional, and organic options that align with long-term wellness goals. Affluent consumers, in particular, are leading this trend, investing in high-quality products that promise health benefits alongside premium taste and innovation.

4.Sustainable Supply

In addition to the domestic factors driving demand in the UAE food and beverage market, the government has implemented a comprehensive policy to address long-term food security challenges.

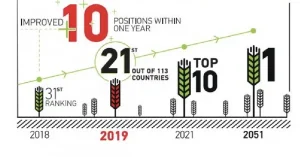

The National Strategy for Food Security, launched in 2018, aims to position the UAE as the world’s best in the Global Food Security Index by 2051 and among the top 10 countries by 2021(UAE Government). This strategy reflects the UAE’s commitment to achieving zero hunger by ensuring access to safe, nutritious, and sufficient food year-round, both domestically and internationally.

The vulnerabilities exposed during the COVID-19 pandemic, including disruptions to supply chains and regional food shortages, highlighted the urgency to strengthen food availability and supply chain resilience. The UAE’s strategy focuses on four key pillars:

- Food availability: Ensuring consistent supply through domestic production and diversified imports.

- Access to nutrition: Promoting availability of adequate and nutritious diets for all.

- Appropriate utilization: Optimizing food use through proper diets, clean water, sanitation, and healthcare.

- Stability in access: Mitigating risks of scarcity and ensuring continuous food supply to all individuals.

To achieve these objectives, the strategy outlines key actions:

- Facilitating global food trade to maintain a steady flow of imports.

- Diversifying import sources, with a focus on securing food from 3 to 5 alternative suppliers for each category to reduce dependency on single markets.

- Enhancing knowledge of domestic consumption patterns, production capacities, and nutritional requirements to inform strategic decisions.

By addressing these areas, the UAE is working toward a robust and resilient food supply chain that can meet the demands of its growing population and mitigate future disruptions. The strategy’s emphasis on diversified sourcing, sustainability, and innovation ensures that food security remains a cornerstone of the UAE’s long-term economic and social development.