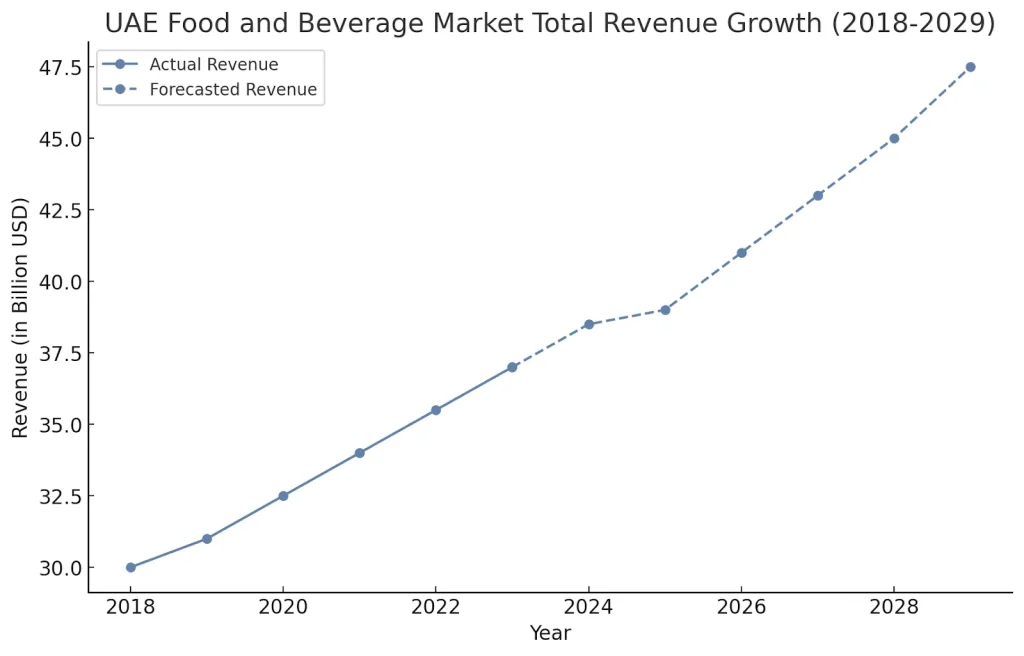

The UAE’s food and beverage market has demonstrated significant growth over the past few years and is projected to maintain this upward trajectory through 2029. As shown in Figure 1, combined revenue for the sector is forecasted to rise from $30 billion in 2018 to approximately $47.8 billion by 2029, marking an impressive overall growth of nearly 60% (Statista, 2024).

- 2018-2023: The market experienced steady growth, with revenue increasing from $30 billion to approximately $36.5 billion by 2023. This upward trend reflects rising consumer spending, population growth, and increased demand for both essential food items and premium offerings.

- 2024-2029 (Forecasted): The graph projects consistent growth over the next six years, with revenue reaching $47.8 billion by 2029.

The growth of the UAE’s food and beverage market reflects the country’s dynamic and expanding economy, driven by a combination of domestic consumption, international trade, and strategic government initiatives. This upward trend highlights rising consumer spending, population growth projected to reach 15.37 million by 2050, and increased tourism inflows that boost demand in the hospitality sector. Additionally, evolving consumer preferences, including a greater emphasis on premium products and health-focused offerings, further underscore the sector’s resilience and adaptability in meeting diverse and growing demands.

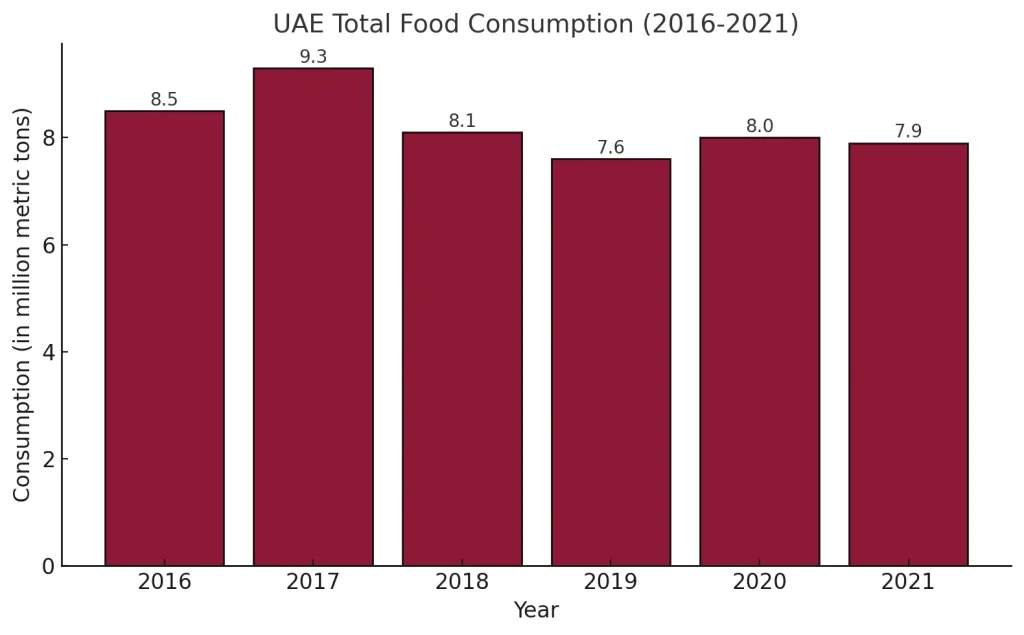

Despite the above steady growth in food and beverage revenue within the UAE market, total food consumption experienced notable fluctuations between 2016 and 2021. These variations reflect the impact of shifting economic conditions, evolving population dynamics, and external challenges.

According to Figure 2, in 2016, food consumption stood at 8.5 million metric tons, marking a solid baseline driven by a growing population and rising consumer demand. This upward trend continued into 2017, reaching a peak of 9.3 million metric tons, a 9.4% increase over the previous year. The growth during this period highlights the UAE’s robust demand for food, supported by economic stability, a steady influx of expatriates, and increased per capita consumption.

However, the years 2018 and 2019 saw a decline in total food consumption, dropping to 8.1 million metric tons in 2018 and further to 7.6 million metric tons in 2019. This 18% cumulative decline from the 2017 peak likely reflects broader economic pressures and shifts in consumer behavior. Contributing factors may include changing dietary habits, regional economic adjustments, or a growing emphasis on food waste reduction and sustainable consumption practices.

Following this period of decline, food consumption began to stabilize in 2020, rebounding to 8.0 million metric tons. By 2021, consumption settled at 7.9 million metric tons, indicating a steady recovery despite the disruptions caused by the COVID-19 pandemic, which resulted in a decline in tourism as well. The pandemic highlighted the importance of food security and resilience within supply chains, likely driving increased demand for essential goods and stabilizing consumption levels.

The trends observed between 2016 and 2021 highlight the UAE’s sensitivity to economic and external challenges, particularly given its reliance on food imports for over 85% of its supply. The initial growth, followed by a period of decline and subsequent recovery, demonstrates the market’s resilience and adaptability. As consumption patterns stabilize, it becomes clear that rising demand, coupled with a growing population and expanding tourism sector, is driving significant opportunities for revenue growth across the food market.

Overall, the UAE’s food and beverage market is characterized by steady growth in volume and revenue, with emerging trends focused on premiumization, health-conscious choices, and convenience. While fresh foods maintain a foundational role with consistent growth, ready-to-use foods and beverages are driving dynamic market expansion, reflecting evolving consumer lifestyles and preferences. As these trends continue, the market is set to benefit from increasing demand for high-quality, innovative, and sustainable products, catering to the needs of an expanding and increasingly sophisticated consumer base.

The following section provides a detailed analysis of the key categories driving growth in the UAE’s food and beverage market: fresh foods, ready-to-use foods, and beverages. The aim of this report is to identify the intersection between UAE consumption trends and Iranian production capabilities. Given Iran’s strong potential in fresh foods and beverages, this report will place a particular emphasis on these two categories, exploring them in greater detail.

Fresh Foods

Fresh Foods represent a cornerstone of the UAE’s food market, driven by increasing consumer demand for wholesome and natural products. Despite the fluctuation in food consumption, fresh foods, including meat, vegetables, seafood, fruits and nuts, demonstrate steady volume growth. Within fresh foods, vegetables, fruits and nuts are benefiting from a rising demand for health-conscious and plant-based dietary preferences. This section delves deeper into the UAE, highlighting consumer trends and behaviors within the market.

In the fresh foods category, six key subcategories cater to diverse consumer demands: nuts and dried fruits, spices, fresh fruits, vegetables, eggs and dairy, and meat and seafood. Each of these segments plays a vital role in meeting the UAE market’s need for high-quality, fresh, and culturally relevant food products. Among these, the nuts and dried fruits category holds particular significance, combining nutritional value, long shelf life, and a deep-rooted cultural connection in both the UAE and Iranian markets. For the purpose of this report, the nuts and dried fruits category is explored by addressing its market dynamics, consumer preferences, and potential for Iranian products to fill existing gaps and capture this highly promising niche within the UAE’s fresh foods sector.

- Nuts and Dried Fruits

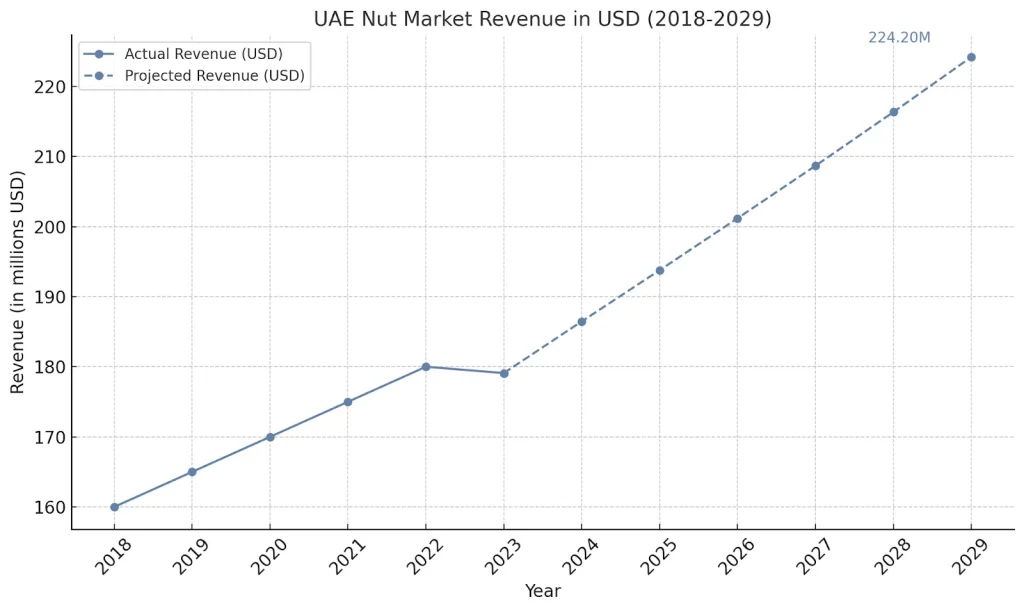

The UAE’s Nuts and Dried Fruits market demonstrates consistent growth, driven by changing consumer preferences for healthier and premium snack options. In 2024, the market is expected to generate $179.1 million, highlighting its significant contribution to the UAE’s snack and health food segment (Figure 3).

This growth is fueled by increasing health consciousness, as consumers seek nutritious alternatives to traditional junk food, with nuts offering essential nutrients that appeal to health-focused individuals. Additionally, a premiumization trend is evident, as rising disposable incomes drive demand for high-quality, organic, and exotic nuts.

Looking ahead, the market is projected to grow at a CAGR of 4.12% from 2024 to 2029, reflecting steady expansion. Key opportunities include the growing demand for convenient, on-the-go snacks, with packaged nuts and dried fruits catering to busy lifestyles. Diversification into flavored and value-added products, such as spiced nuts and chocolate-coated varieties, presents further growth potential. Moreover, cultural and seasonal consumption during festivities like Ramadan continues to boost demand, underscoring the market’s resilience and alignment with consumer trends.

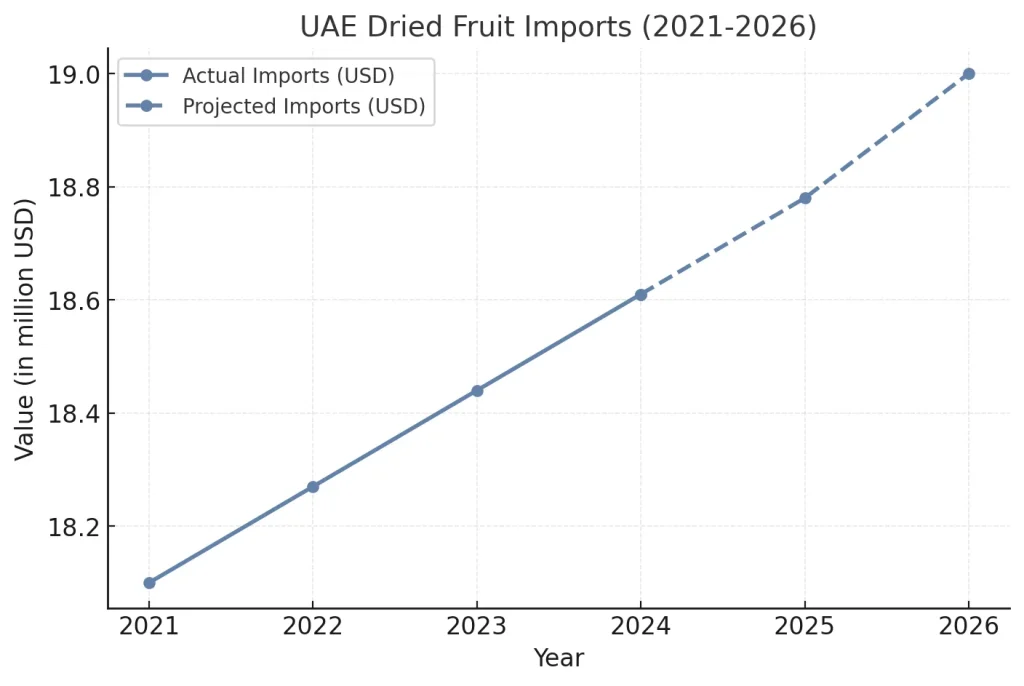

The Dried Fruits segment is forecasted to reach $19 million in imports by 2026, growing at a modest annual rate of 0.9%. As depicted in Figure 4, the market has shown consistent growth since 2012, with actual consumption rising from $3.8 million to $4.4 million in 2023. Projections indicate further growth, surpassing $4.6 million by 2026. This sustained demand underscores the integration of dried fruits into local consumption habits, driven by their perceived health benefits and cultural significance.

Iran boasts a global reputation and rich heritage in producing top-quality nuts and dried fruits, making it well-positioned to meet this rising demand. With an annual nut production of over 1.18 million tons, approximately 800,000 tons are consumed domestically, leaving substantial volumes for export. On the dried fruits front, Iran’s exports are projected to grow to $29 million by 2026, expanding steadily at an annual growth rate of 0.8% since 2021, when export values stood at $27.6 million (Report Linker).

These figures underscore Iran’s robust production capacity and established presence in the international market. By capitalizing on its production strengths, international reputation, and deep-rooted heritage, Iran is well-equipped to address the UAE’s growing demand for high-quality nuts and dried fruits. With targeted efforts in branding, packaging, and marketing, Iranian producers can unlock the full potential of this market and strengthen their foothold in the UAE’s thriving market.

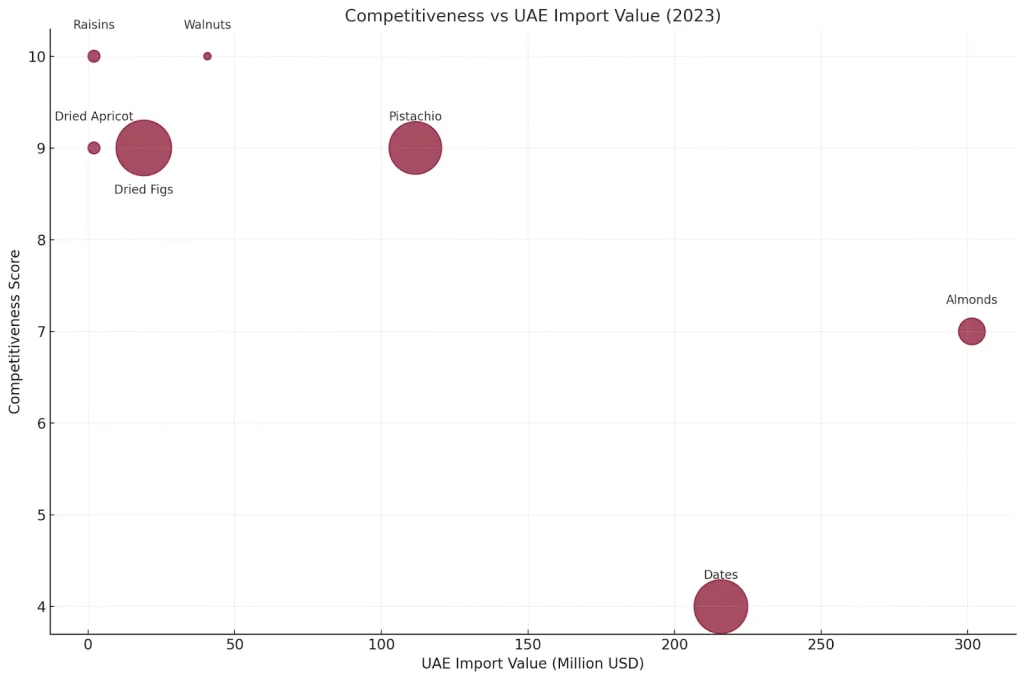

Figure 5 highlights the positioning of Iranian nuts and dried fruits in the UAE market based on global quality rankings, import values (2023), and growth potential (CAGR 2020–2023).

The graph shows where each product stands in terms of competitiveness and market demand.

Key products like Walnuts, Dates, and Dried Figs have strong growth potential and competitive advantages, while Pistachios and Almonds face higher competition despite their demand.

The nuts and dried fruits displayed in the chart include Pistachio, Almonds, Walnuts, Dates, Dried Figs, Raisins, and Dried Apricot. The chart provides a visual representation of how these products perform in terms of import value, competitiveness, and growth potential in the UAE market.

Additionally, Raisins and Dried Apricots, unique to Iran, present untapped opportunities. If strategically introduced, these products could capture significant market attention and strengthen Iran’s presence in the UAE.

As mentioned above, within the nuts and dried fruits category, a wide array of products caters to diverse consumer tastes and preferences. Several high-potential products were identified, including pistachios, almonds, walnuts, dried figs, dried plums, dried apricots, raisins, and dates. These products hold significant appeal in the UAE market, offering nutritional value, versatility, and strong cultural resonance. For the purpose of this report, the dried figs segment will be analyzed further, delving into its unique market dynamics, consumer appeal, and the opportunities it presents for Iranian producers to establish a competitive presence in the UAE market. This in-depth exploration will highlight the potential for dried figs to emerge as a cornerstone product within the broader nuts and dried fruits category.

1.1 Dried Figs

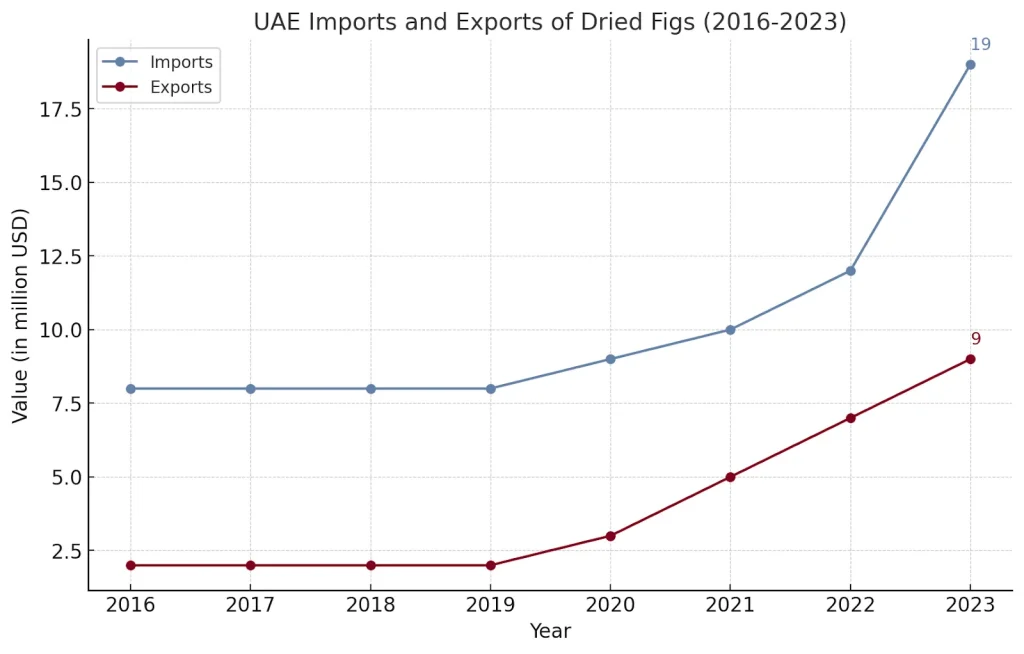

The UAE has established itself as a vital hub for the dried fig market, leveraging its strategic geographic location, advanced trade infrastructure, and a rapidly growing, health-conscious population. Based on Figure 6, in 2023, the UAE imported dried figs worth $19 million, demonstrating an impressive 108% three-year growth rate. This substantial increase highlights the rising demand for dried figs in the UAE, fueled by their appeal as a natural, nutritious snack and a versatile ingredient in both traditional and modern cuisine. The UAE also re-exported $9 million worth of dried figs in the same year, underscoring its role as a trading gateway to neighboring GCC countries.

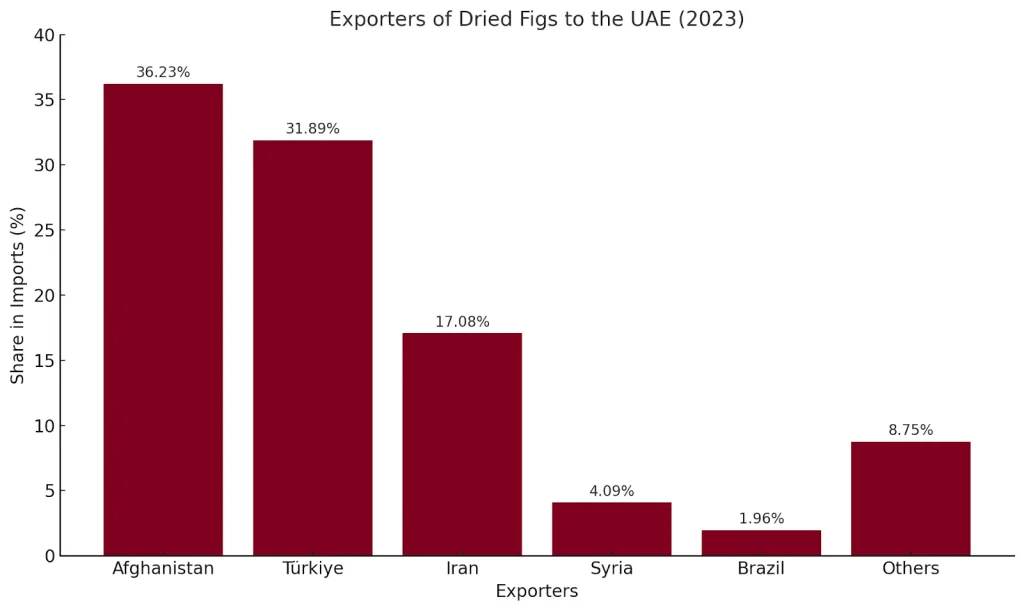

Iran ranks as the third-largest exporter of dried figs to the UAE, contributing $19 million annually (3,800 tons). Despite strong competition from Afghanistan (36.23% share) and Turkey (31.89%), Iranian dried figs remain highly competitive due to their exceptional sweetness, chewy texture, and superior nutritional content. Iran is among the top five global producers of dried figs, with an annual output of 19,205 tons and exports valued at $57.53 million. These attributes position Iranian dried figs as a premium offering in the UAE market, appealing to both local consumers and regional re-export markets.

Iranian dried figs, particularly celebrated for their high levels of dietary fiber, antioxidants, and essential vitamins, align with the UAE’s growing demand for health-oriented products. This alignment, coupled with their rich flavor and cultural significance, creates a strong foundation for Iranian figs to thrive in the UAE. Their versatility also extends to creating value-added products, including fig-based teas, desserts, and functional foods, catering to a diverse consumer base.

Iranian dried figs, particularly celebrated for their high levels of dietary fiber, antioxidants, and essential vitamins, align with the UAE’s growing demand for health-oriented products. This alignment, coupled with their rich flavor and cultural significance, creates a strong foundation for Iranian figs to thrive in the UAE. Their versatility also extends to creating value-added products, including fig-based teas, desserts, and functional foods, catering to a diverse consumer base.

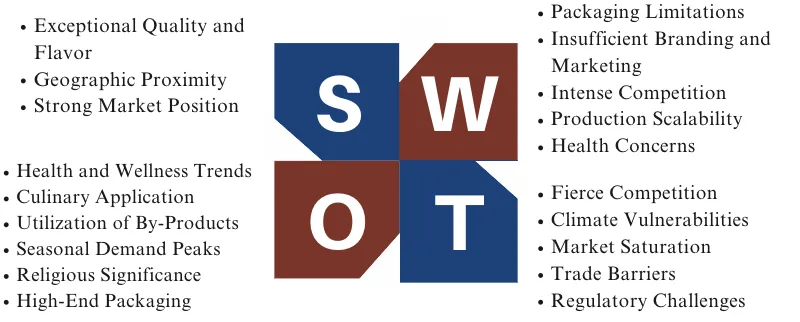

SWOT Analysis of Iranian Dried Figs in the UAE Market

Iranian dried figs hold immense potential in the UAE market due to their exceptional quality, cultural relevance, and alignment with health-conscious consumer trends.